Auto bumper repair is often covered under comprehensive auto insurance policies, but specifics vary. Review policy documents and clarify coverage with your provider. Regular maintenance and prompt attention to damage can prevent costly repairs. Understand your policy's coverage extent, including deductibles and past claims eligibility. File a claim if eligible, document expenses, and engage a trusted mechanic for accurate, industry-standard repairs.

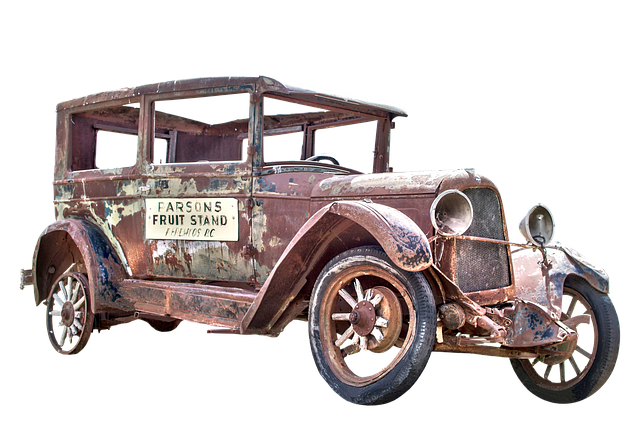

Are you wondering if insurance covers your auto bumper repair costs? You’re not alone. In today’s world, understanding automotive insurance policies can be a hassle. This article serves as your guide through the process, delving into crucial aspects of auto bumper repair coverage. We’ll explore when and how insurance companies step in to facilitate repairs, providing peace of mind for road-ready vehicles. By navigating claims effectively, you can ensure a smooth process and get back on the road faster.

- Understanding Auto Bumper Repair Coverage

- When Insurance Covers Repair Costs

- Navigating Claims for Bumper Damage Repair

Understanding Auto Bumper Repair Coverage

When it comes to auto bumper repair, insurance coverage can be a lifesaver. Understanding what your policy entails is crucial before you face unexpected repairs. Most comprehensive auto insurance policies include some form of coverage for exterior damage, which often includes auto bumper repair. This means if your bumper gets dented or damaged in an accident or due to weather conditions, your insurance company might step in to help with the costs.

The specifics can vary greatly from one policy to another. Some insurers may cover 100% of the repairs, while others might have deductibles or specific criteria for claims. It’s essential to review your policy documents carefully and reach out to your insurance provider if you’re unsure about what’s covered. Regular auto maintenance and prompt attention to any damage can also help prevent costly repairs down the line.

When Insurance Covers Repair Costs

When it comes to auto bumper repair, understanding what your insurance policy covers is essential. Many standard auto insurance policies include coverage for damage to your vehicle’s exterior, including the bumper. This typically applies when the damage is the result of an accident or other covered events, such as a collision with another vehicle, a deer, or other wildlife, or even severe weather conditions like hailstorms.

The extent of coverage can vary between policies, and certain factors may influence whether your auto bumper repair costs will be fully or partially covered. These include the type of damage sustained by the bumper—if it’s a minor dent or crack, compared to a complete detachment or severe deformation—and whether you’ve made claims for similar damages in the past. Additionally, some policies might have deductibles that apply to such repairs, meaning you’ll need to pay a certain amount out-of-pocket before your insurance kicks in. A reputable car body shop can provide guidance on navigating these aspects and help you determine if your luxury vehicle repair is eligible for coverage under your current policy.

Navigating Claims for Bumper Damage Repair

Navigating claims for bumper damage repair can seem daunting, but understanding your insurance coverage is key. The first step involves reviewing your policy to determine if auto bumper repair is included under comprehensive or collision coverage. Comprehensive typically covers damages from non-crash events like weather or animal encounters, while collision coverage is for accidents and their aftermath. If you’re eligible, contact your insurance provider to file a claim.

During the claims process, document all expenses related to the auto bumper repair. This includes parts costs as well as labor fees. Keep receipts and take photos of the repair work to support your claim. Be prepared to provide detailed information about the incident leading to the damage, such as date, location, and how the dent or collision occurred. Engaging with a trusted mechanic can also help streamline the process by ensuring accurate repairs that meet industry standards for vehicle collision repair.

Insurance may cover your auto bumper repair costs, making it essential to understand your policy and navigate claims efficiently. If damage is due to a covered event, such as an accident or vandalism, you can rest assured that many policies will assist in repairing or replacing your vehicle’s bumper. By familiarizing yourself with your coverage and following the right steps when filing a claim for auto bumper repair, you can ensure a smoother process and potentially reduce out-of-pocket expenses.